ri tax rate on unemployment benefits

Reminder about taxes on unemployment benefits. Job Development Fund Tax Employers pay an assessment of 021 to support the Rhode Island Governors Workforce Board as well as employment services and unemployment insurance activities.

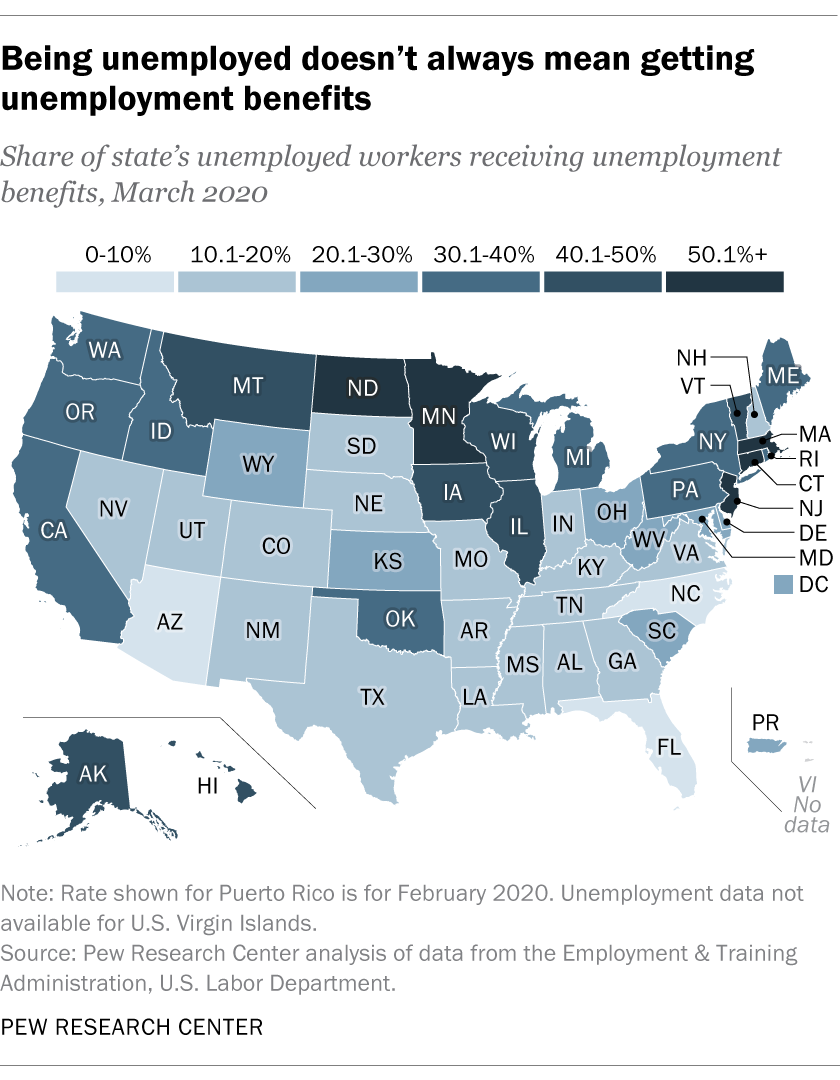

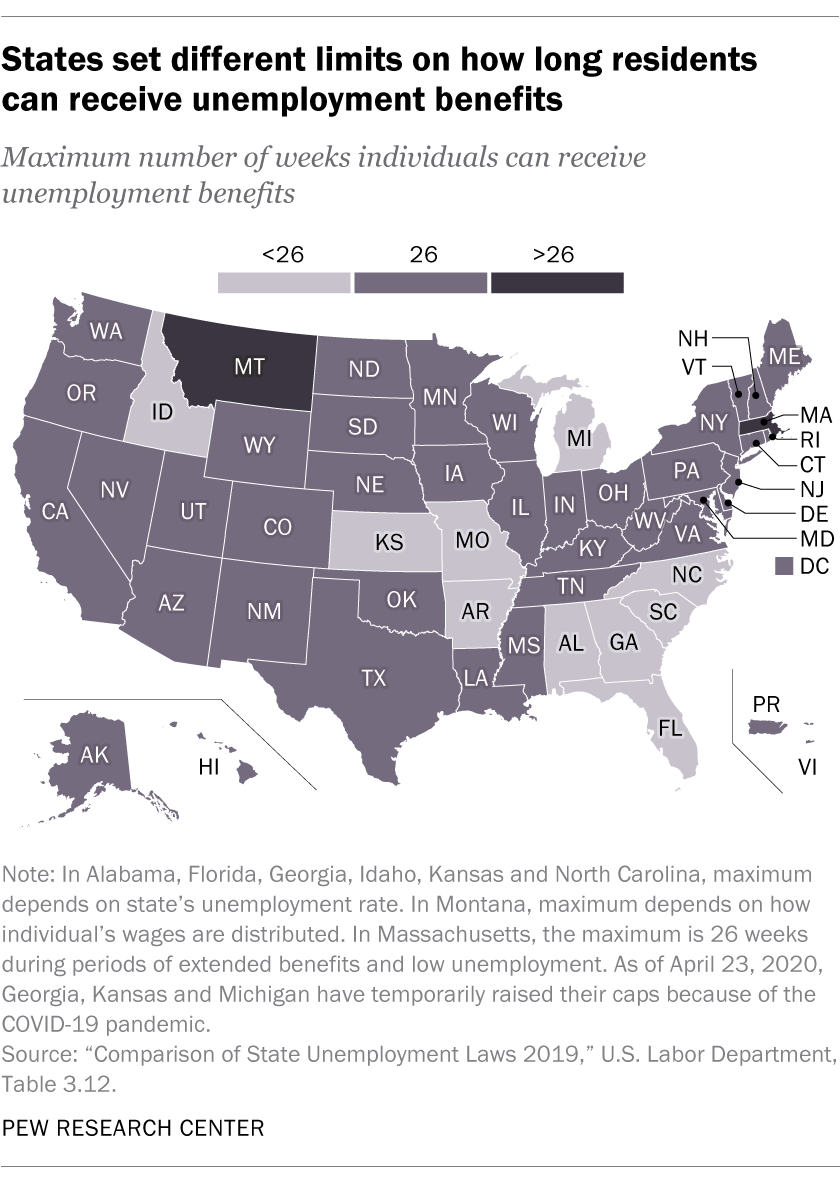

In Some States Very Few Unemployed People Get Unemployment Benefits Pew Research Center

The UI taxable wage base is set at 465 percent of the average annual wage of workers at taxable employers.

. Is it possible that the 2021 Tax Rate Schedule will be adjusted as a result of the number of. Twenty percent higher than the national unemployment rate is rounded to 534 percent. Deadline extended for certain exemption certificates.

Unemployment insurance payments are taxable income. However the State of Rhode Island will use the same tax rate schedule for 2019 that it used for 2018 -- Schedule G. This is an increase of 7500 101 from the 2021 taxable wage base of 74000.

Contributions collected from Rhode Island employers under this tax are used exclusively to pay benefits to unemployed workers. If you receive a letter from the IRS or Form 1099-G from the Rhode Island Department of Labor and Training regarding. Tax Schedule F with rates ranging from 09 percent to 94 percent was in effect in calendar year 2020.

Which reimbursable employers are required to reimburse states for benefits paid to their workers who claim unemployment insurance by 50 percent through December 31 2020. The taxable wage base for Rhode Islands state unemployment insurance tax UI will be 24600 in 2021 for most employers compared with 24000 in 2020 an increase of 600 or approximately 25. Your weekly benefit rate will be equal to 385 of the average of the total wages in the two highest quarters of the base period not to exceed the defined maximum amount.

UI tax rates are calculated using a. TAX RATES120 to 980 Deducted from Employment Security099 to 959 Employees Wages Job Development Assessment JDA021 NEW EMPLOYER RATE095 not including 021 JDANone Employee Tax EMPLOYEE WAGE DEDUCTIONNONE employer payroll tax 13 of first 74000 earned WAITING PERIOD7 days - beginning on a Sunday. You will need to pay 6 of the first 7000 of taxable income for each employee per year which makes your maximum FUTA tax per employee per year 420Note that if you pay state unemployment taxes in full and on time you are eligible for a tax credit of up to 54 making your FUTA tax rate effectively 06.

The extra 600week the extra 300week and the extra 200week are all included in this amount. Most employers pay Rhode Island UI tax up front each quarter. For example all new employers receive a SUTA rate of 125 in Nebraska and all new construction employers receive a SUTA rate of 54 in 2022.

52 rows The state unemployment insurance rate for new employers varies. How to contact us make payments or use our drop box. Since 534 is below the floor unemployment rate of 600 percent a civil jurisdiction must have a two-year unemployment rate of 600 in order to be classified as a labor surplus area.

Guide to tax break on pension401 kannuity income. Your weekly benefit rate remains the same throughout your benefit year. The Department of Labor and Training DLT on Monday announced that tax rates for the Unemployment Insurance UI program will remain at Schedule H in 2022.

The Department of Labor and Training DLT on Monday announced that tax rates for the Unemployment Insurance UI program will remain at Schedule H in 2022. Some states split new employer rates up by construction and non-construction industries. UI tax rates are calculated using a statutory formula based on the balance of the states employment security fund.

The 1099-G also includes all federal and state unemployment boosts which are also taxable income. 1099-G Tax Information. Beginning July 1 2020 the maximum weekly benefit rate for Unemployment Insurance will increase to 599 per beneficiary an increase of 13 from last years maximum of 586.

The 2021 TDI Contribution Rate was 13 percent. By law the UI taxable wage base represents 465 of the average annual wage in. 2022 Tax Rate 11 percent 0011 The Temporary Disability Insurance contribution rate will be 11 percent for calendar year 2022.

For all unemployment claimants that received benefits in 2021 the 1099-G form is now available to download here. Instead they typically pay back the Rhode Island UI fund on a dollar-for-dollar basis for UI benefits paid to former employees. Taxable wage base generally means the amount of an employees wages to which the tax rate applies.

The TDI Taxable Wage Base for Rhode Island employees will be 81500 in 2022. Some employers known as reimbursable employers typically do not pay UI tax up front. Because of the high.

Instead they typically pay back the Rhode Island UI fund on a dollar-for-dollar basis for UI benefits paid to former employees. For those employers at the highest tax rate the UI taxable wage base will be set 1500 higher at 26100. Contact Local Unemployment Area Statistics LAUS 401-462-8740.

Most employers pay Rhode Island UI tax up front each quarter. The UI taxable wage base will be 24600 for most employers and 26100 for employers at the highest rate. Read our latest newsletter.

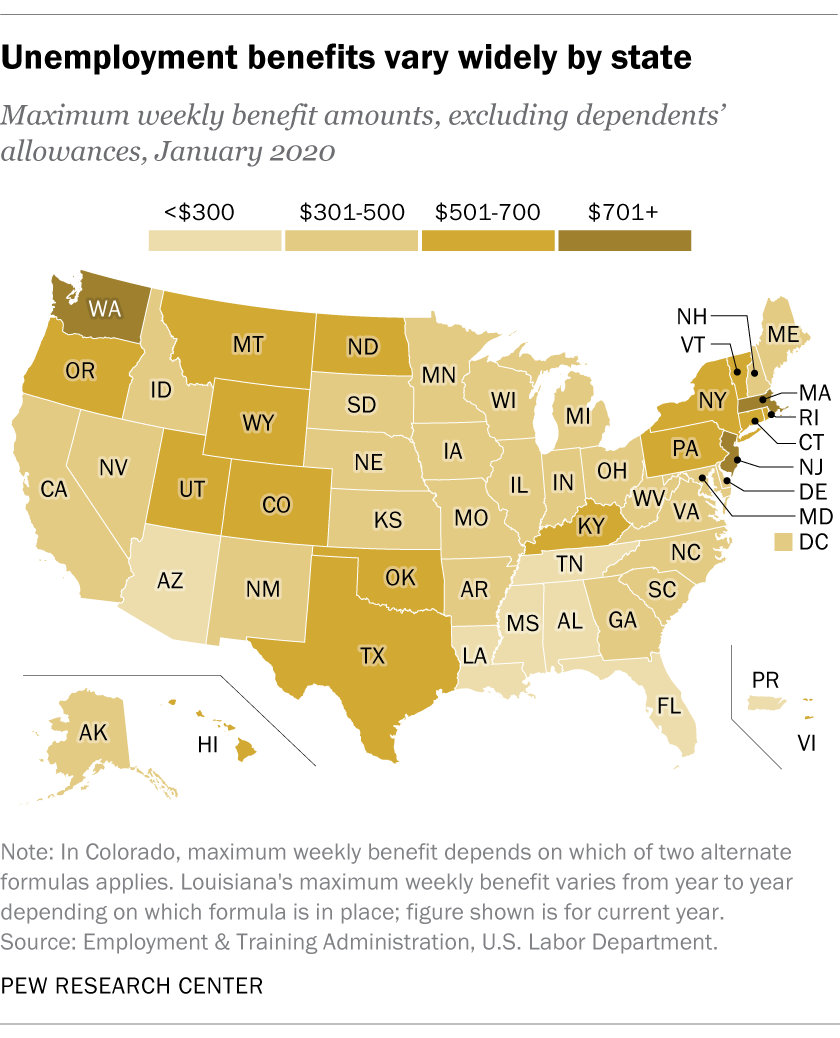

For most Rhode Island employers the taxable wage base for calculating the Rhode Island unemployment insurance UI tax will be 23600 for 2019 compared with 23000 for 2018 an increase of 600 or 261 percent. Effective 1222 the minimum is 62 and maximum is 661 not including dependency allowance. 29 rows Whenever the amount in the Employment Security Fund available for benefits minus any federal advances is less than zero at the end of the second month of any calendar quarter every employer will be required to pay a surtax of 03 of their taxable wages for that quarter in addition to their regular contributions.

Read the summary of the latest tax changes. Accordingly in 2022 the UI taxable wage base for most Rhode Island employers will remain at 24600. Please double check whether you are factoring in the taxes withheld when comparing the 1099-G form with your bank records.

This will also be mailed to claimants. Under federal legislation enacted on March 11 2021 if a taxpayer received unemployment benefits in 2020 and the taxpayers federal adjusted gross income AGI was less than 150000 for 2020 the first 10200 of the taxpayers unemployment benefits is excluded from income for federal tax purposes for 20202. For beneficiaries with the maximum five dependents the maximum weekly benefit rate will be 748.

Some employers known as reimbursable employers typically do not pay UI tax up front. Pay FUTA Unemployment Tax.

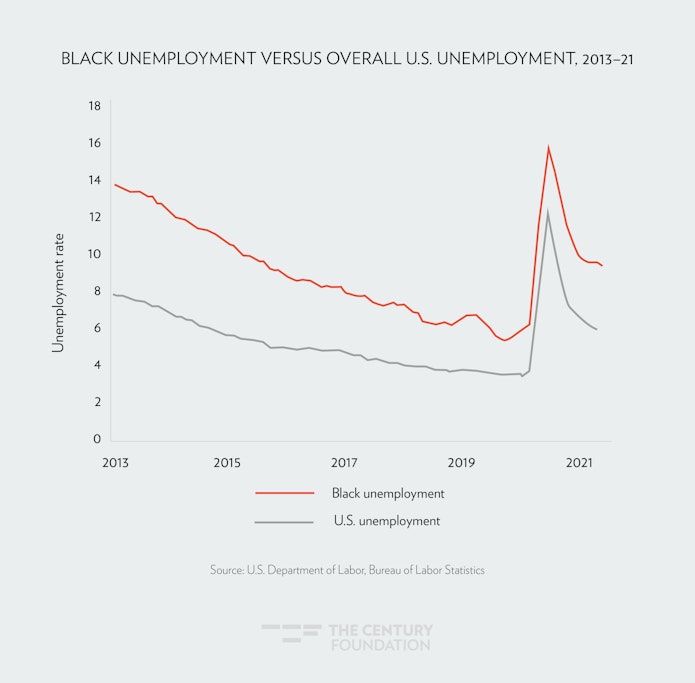

The Long Run Implications Of Extending Unemployment Benefits In The United States For Workers Firms And The Economy Equitable Growth

Andy Boardman Here S How A Rhode Island Employment Bonus Proposal Would Work And How It Can Be Improved

1099 G Unemployment Compensation 1099g

In Some States Very Few Unemployed People Get Unemployment Benefits Pew Research Center

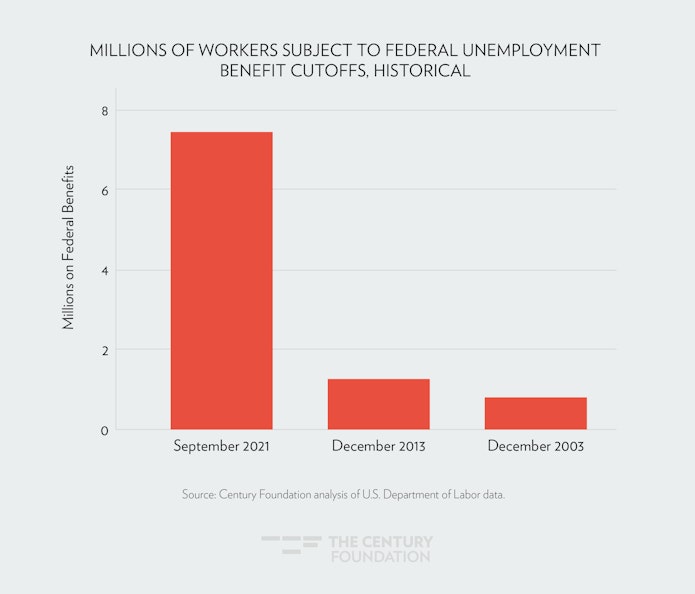

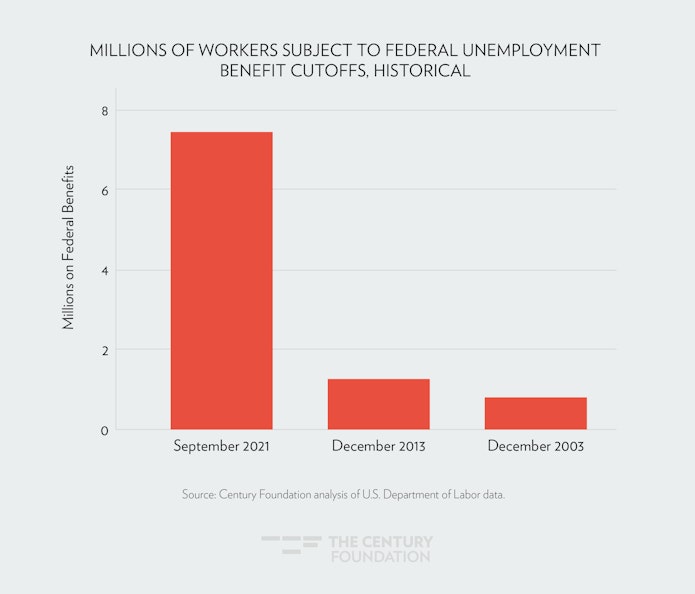

7 5 Million Workers Face Devastating Unemployment Benefits Cliff This Labor Day

The Long Run Implications Of Extending Unemployment Benefits In The United States For Workers Firms And The Economy Equitable Growth

Unemployment Insurance Extended Benefits Will Lapse Too Soon Without Policy Changes

How Unemployment Benefits Are Calculated By State Bench Accounting

Delivering Unemployment Assistance In Times Of Crisis Scalable Cloud Solutions Can Keep Essential Government Programs Running And Supporting Those In Need

600 Unemployment What Happens When A Stimulus Lifeline Ends The New York Times

In Some States Very Few Unemployed People Get Unemployment Benefits Pew Research Center

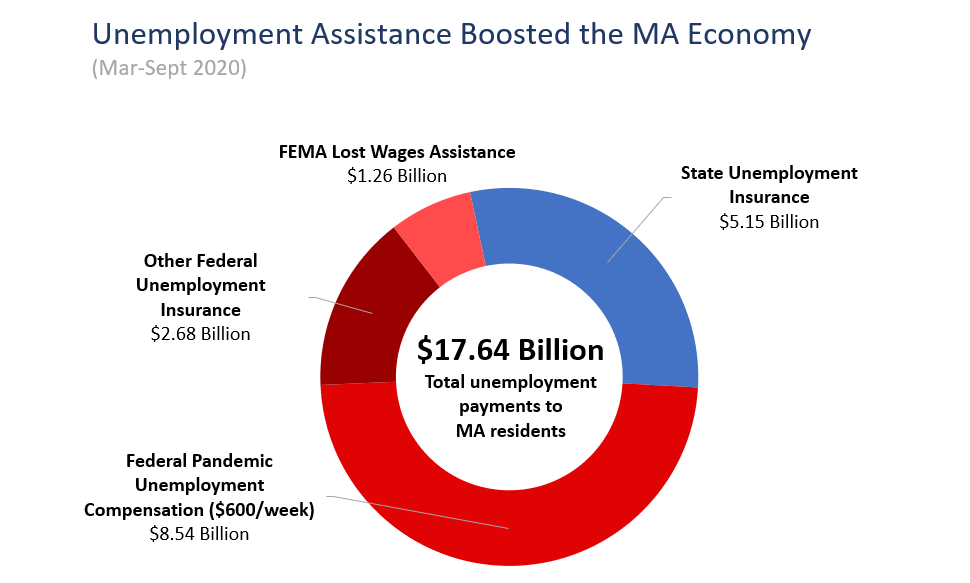

Unemployment Insurance Saved The Massachusetts Economy How Can We Ensure It Will Be Strong For The Future Mass Budget And Policy Center

1099 G Tax Information Ri Department Of Labor Training

Will Kuroda Leave Before Second Term Ends Term Marcus Aurelius Bank Of Japan

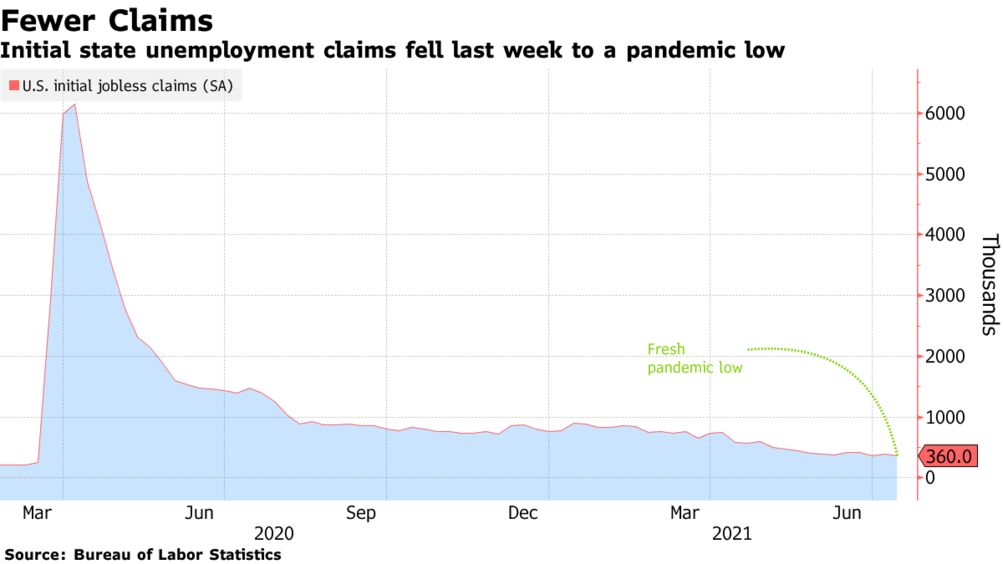

Us Unemployment Benefits Applications Fall To New Pandemic Low Bloomberg

Unemployment Benefits Comparison By State Fileunemployment Org

Unemployment Insurance Extended Benefits Will Lapse Too Soon Without Policy Changes

7 5 Million Workers Face Devastating Unemployment Benefits Cliff This Labor Day

600 Unemployment What Happens When A Stimulus Lifeline Ends The New York Times